MinesOnline.com Reviews St Barbara’s Acquisition of Atlantic Gold Corporation

MinesOnline.com Reviews St Barbara’s Acquisition of Atlantic Gold Corporation

On 15 May 2019, St Barbara Limited (St Barbara) (ASX:SBM) announced1 that it has agreed to acquire Atlantic Gold Corporation (Atlantic) (TSX-V:AGB) for cash consideration of C$2.90 (US$2.16)2 per share (the Transaction) via a Canadian Plan of Arrangement Agreement. Upon completion of the Transaction, Atlantic and its associated entities will become part of St Barbara and Atlantic will be de-listed from the TSX-V. The Transaction remains subject to customary closing conditions, including a vote by Atlantic’s shareholders, however, MinesOnline.com notes that Atlantic’s directors control 32% of Atlantic’s share register and have entered into a lock-up agreement to vote in favour of the Transaction.

Under the terms of the Transaction, St Barbara will acquire 100% of all outstanding Atlantic shares (on a fully diluted basis) at an all cash offer price of C$2.90 (US$2.16) per share and C$35M (US$26M) to acquire all outstanding options, implying a total equity value for Atlantic of C$722M (US$537M) and a total enterprise value (EV) for Atlantic of C$802M (US$597M). The Transaction excludes Atlantic’s 36% interest in Velocity Minerals Limited (TSX-V:VLC), which has a market value of C$9M (US$7M) and will be spun out to existing Atlantic shareholders.

Atlantic’s primary asset is the Moose River Consolidated Project (Moose River) in Nova Scotia, comprising the Touquoy Gold Mine (Touquoy) and three additional pits (the Beaver Dam, Fifteen Mile Stream and Cochrane Hill Projects) for development. Whilst Atlantic owns 100% of the Beaver Dam, Fifteen Mile Stream and Cochrane Hill Projects, Atlantic only holds a 63.5% beneficial interest in Touquoy. Moose River declared commercial production in March 2018, producing 91koz Au in the 2018 calendar year at an all-in sustaining cost (AISC) of C$731/oz (US$544/oz) Au, with production guidance for the 2019 calendar year of 92-98koz Au. Moose River has total Ore Reserves of 1.9Moz Au and Mineral Resources of 2.4Moz Au, however, when adjusted for Atlantic’s 63.5% beneficial interest in Touquoy, Atlantic has attributable Ore Reserves of 1.7Moz Au and attributable Mineral Resources of 2.2Moz Au.

Transaction Market Metrics Comparison

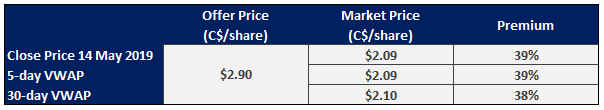

Under the terms of the Transaction, St Barbara will pay C$2.90 (US$2.16) for each Atlantic share, representing a premium of 39% to Atlantic’s closing price of C$2.09 (US$1.56) per share on 14 May 2019 (the last trading day prior to the announcement of the Transaction) and a premium of 39% and 38% to Atlantic’s 5 and 30 day volume weighted average prices of C$2.09 (US$1.55) and C$2.10 (US$1.56) per share respectively.

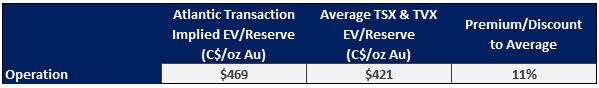

As Atlantic has existing gold production at Moose River, MinesOnline.com has classified Atlantic as a Gold Producer. On an Ore Reserve basis, the Transaction occurred at an implied EV/Reserve multiple of C$469/oz3 (US$349/oz) Au, a premium of 11% to the average EV/Reserve multiple of TSX and TSX-V listed Gold Producers of C$421/oz (US$313/oz) Au.

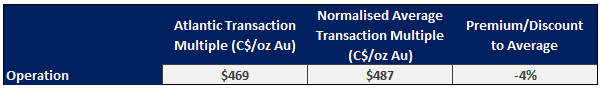

MinesOnline.com notes that listed companies are known to potentially trade at a minority interest and as such, it may be appropriate to apply a control premium to average EV/Reserve multiples for comparison purposes. However, as Atlantic’s value is primarily attributable to Moose River (a “single asset” operation), MinesOnline.com has chosen to compare the Transaction to a transaction multiple based on a selected group of equivalent gold operation transactions4.

Therefore, on an Ore Reserve basis, the Transaction occurred at C$469/oz (US$349/oz) Au which is broadly in line with MinesOnline.com’s normalised5 average transaction multiple of C$487/oz (US$363/oz) Au for the selected group of equivalent gold transactions. For comparison purposes, the recent acquisition of the Pogo Gold Mine by Northern Star Resources Limited occurred at a normalised transaction multiple of C$491/oz (US$365/oz) Au on an Ore Reserve Basis.

1 See St Barbara’s announcement here.

2 Based on CADUSD of 0.7440 as at 30 April 2019.

3 EV/Reserve multiple based on Atlantic’s attributable Ore Reserves.

4 Transactions include Northern Star Resources Limited’s acquisition of the Pogo Gold Mine, Minjar Gold Pty Ltd’s acquisition of the Southern Cross Operations, Evolution Mining Limited’s acquisition of the Cowal Gold Mine and Evolution Mining Limited’s acquisition of La Mancha Group BV’s Australian operations.

5 Average metrics normalised using 30 April 2019 commodity prices.

MinesOnline.com

The Global Marketplace for Mining Projects

Register today for free, unrestricted access to all project listings, market metrics and transaction valuations.

Projects can be posted on MinesOnline.com for a 5% success fee or a negotiated upfront posting fee.