MinesOnline.com Reviews Beacons Acquisition of the MacPhersons Reward Gold Project

On 24 August 2021, Beacon Minerals Limited (ASX:BCN) (Beacon) announced that it had entered into an agreement with Primary Gold Pty Ltd (Primary Gold) to acquire 100% of the of the outstanding shares in Primary Gold’s subsidiary, MacPhersons Reward Pty Ltd (MacPhersons Reward) and with it, the MacPhersons Reward Gold Project (MacPhersons or the Project), located 5km southeast of Coolgardie (the Agreement).

Primary Gold is a wholly owned subsidiary of Hanking Australia Investments Pty Ltd (Hanking).

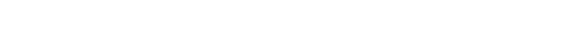

Under the terms of the Agreement, Beacon will acquire 100% of the Project for a total cash payment of A$14M (US$10M) (the Transaction).In 2020, Hanking released a JORC (2012) Mineral Resource Estimate for the Project to the Hong Kong Stock Exchange stating 9.89Mt at 1.10g/t Au for ~0.35Moz of gold.

In 2017, Primary Gold completed a Pre-Feasibility Study for MacPhersons. Noting this and the fact that Beacon own a plant at its nearby Jaurdi Gold Project, MinesOnline.com has reviewed the Transaction using comparable Development stage deals.

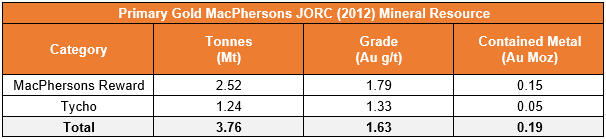

Based on the Transaction amount of US$10M and assuming the Hanking reported Resource of ~0.35Moz Au is true and correct, Beacon will pay US$29/oz Au, representing a discount of 41%, 34% and 34% to MinesOnline.com’s 1, 3 and 5 year average Development Multiples of US$49/oz Au, US$44/oz and US$44/oz, respectively.

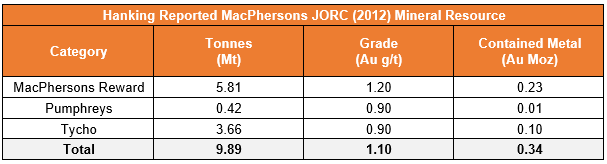

Alternatively, if we apply the Primary Gold Resource estimate of 0.19Moz, Beacon will be pay US$51/oz Au, representing a premium of 4%, 16% and 16% to MinesOnline.com’s 1, 3 and 5 year average Development Multiples of US$49/oz Au, US$44/oz and US$44/oz, which is in line with MinesOnline.com’s metrics.

Set out below is a summary of MinesOnline.com’s Transaction Metrics Analysis:

MinesOnline.com

The Global Marketplace for Mining Projects

Register today for free, unrestricted access to all project listings, market metrics and transaction valuations.

Projects can be posted on MinesOnline.com for a 5% success fee or a negotiated upfront posting fee.