MinesOnline.com Reviews Lundin’s Acquisition of the Chapada Copper-Gold Mine, Brazil

MinesOnline.com Reviews Lundin’s Acquisition of the Chapada Copper-Gold Mine, Brazil

On 15 April 2019, Lundin Mining Corporation (Lundin) (TSX:LUN) announced1 that it has agreed to acquire Yamana Gold Inc’s (Yamana) (TSX:YRI) Chapada Copper-Gold Mine (Chapada or the Project), located in Goiás, Brazil, for upfront cash consideration of US$800M, contingent payments of up to US$225M and a 2.0% Net Smelter Royalty (NSR) on future gold production from the Project’s Suruca gold deposit (the Transaction).

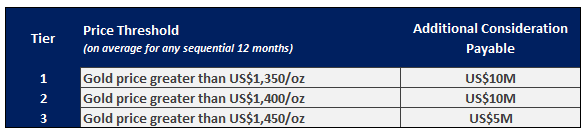

Under the terms of the Transaction, Lundin will pay Yamana US$800M in cash upon closing of the Transaction, subject to customary adjustments, and pay a 2.0% NSR on any future gold production from the Project’s Suruca gold deposit. In addition to the upfront cash and royalty consideration, Lundin will also be liable, for a period of five years post Transaction closing, to pay additional tiered amounts where, in any sequential 12 month period, certain average gold price thresholds are met, as set out below:

Furthermore, Lundin will also pay Yamana a further US$100M should a pyrite roaster at the Project be developed in the future.

Chapada is an operating open-pit copper-gold mine located in Goiás, Brazil. The Project hosts Mineral Resources of 1,404Mt at 0.21% Cu and 0.19g/t Au and Ore Reserves of 730Mt at 0.23% Cu and 0.19g/t Au. The Project has been operating since 2007, and in 2018 produced ~59kt Cu and ~121koz Au, with expected 2019 production of ~55kt Cu and ~100koz Au.

Transaction Market Metrics Comparison

Normalised Average Multiples2

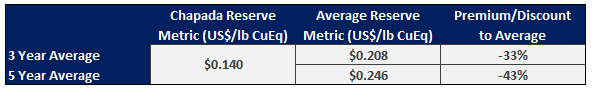

As Chapada is an operating open-pit mine, MinesOnline.com has attributed the Project Operational status. On an Ore Reserve basis, Chapada transacted at US$0.140/lb CuEq3,4, a discount of 33% to MinesOnline.com’s 3 year normalised average of US$0.208/lb CuEq and a discount of 43% to MinesOnline.com’s 5 year normalised average of US$0.246/lb CuEq.

MinesOnline.com notes that Chapada is a high tonnage, low grade copper-gold mine located in a tier two jurisdiction, which likely accounts for the Transaction’s discount to MinesOnline.com’s average transaction metrics.

In addition to the high tonnage and low grade of the Project’s Mineral Resources and Ore Reserves, MinesOnline.com notes that Yamana has undertaken various initiatives to improve Project output, including processing plant optimisation in 2016 and 2017 to increase recoveries. Lundin has indicated that it is looking to further evaluate value creating scenarios at the Project, such as further optimisation and/or expansion of the processing plant and a potential relocation of some plant infrastructure to allow for the potential push-back of pit walls and the development of the Project’s Sucupira deposit. MinesOnline.com notes that these work streams will likely require further capital expenditure which may have also been a contributing factor to the Transaction’s discount to MinesOnline.com’s average transaction metrics.

1 See Lundin’s announcement here.

2 Average metrics normalised using 30 April 2019 commodity prices.

3 Reserve equivalents calculated based on commodity prices as at 30 April 2019 and do not account for recoveries.

4 Only non-contingent consideration is included in the calculation of transaction metrics.

MinesOnline.com

The Global Marketplace for Mining Projects

Register today for free, unrestricted access to all project listings, market metrics and transaction valuations.

Projects can be posted on MinesOnline.com for a 5% success fee or a negotiated upfront posting fee.