MinesOnline.com Reviews Galena’s Partial Sale of the Abra Base Metals Project, Western Australia

MinesOnline.com Reviews Galena’s Partial Sale of the Abra Base Metals Project, Western Australia

On 30 January 2019, Galena Mining Limited (Galena) (ASX:G1A) announced1 the execution of a terms sheet with Toho Zinc Co. Limited (Toho) setting out the proposed terms of Galena’s sale of 40% of the Abra Base Metals Project (Abra or the Project) for total consideration of A$90M (US$63M)2 across three tranches.

Under the terms of the proposed transaction, Abra will pay Galena A$90M3 (US$63M) for 40% of the Project in the form of A$20M (US$14M) (for 8.89% of the Project) upon initial closing of the transaction, A$10M (US$7M) (for a further 4.44% of the Project) upon Galena issuing a Definitive Feasibility Study on the Project and A$60M (US$42M) (for a further 26.67% of the Project) upon confirmation of project financing debt for the Project and satisfaction of all conditions for draw down of the Project’s financing debt.

The Project is located ~200km north of Meekatharra in the Gascoyne Region of Western Australia and hosts a JORC 2012 compliant Mineral Resource of 37.4Mt at 7.5% Pb and 18g/t Ag.

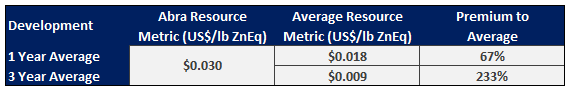

Transaction Market Metrics Comparison

Normalised Average Multiples4

As Abra has a completed Preliminary Feasibility Study, MinesOnline.com has attributed the Project Development status. Due to the dearth of comparable lead transactions and in the absence of a better alternative proxy, MinesOnline.com believes that some price and value guidance can be obtained through converting the Abra lead Resource into a zinc equivalent and then comparing with similar zinc transactions.

On a Mineral Resource basis, Abra transacted at US$0.030/lb ZnEq, a premium of 67% to MinesOnline.com’s 1 year normalised average of US$0.018/lb ZnEq and a premium of 233% to MinesOnline.com’s 3 year average of US$0.009/lb ZnEq. MinesOnline.com believes this premium may reflect Abra’s status as one of the largest undeveloped lead deposits in the world along with an improving market sentiment with regards to base metals.

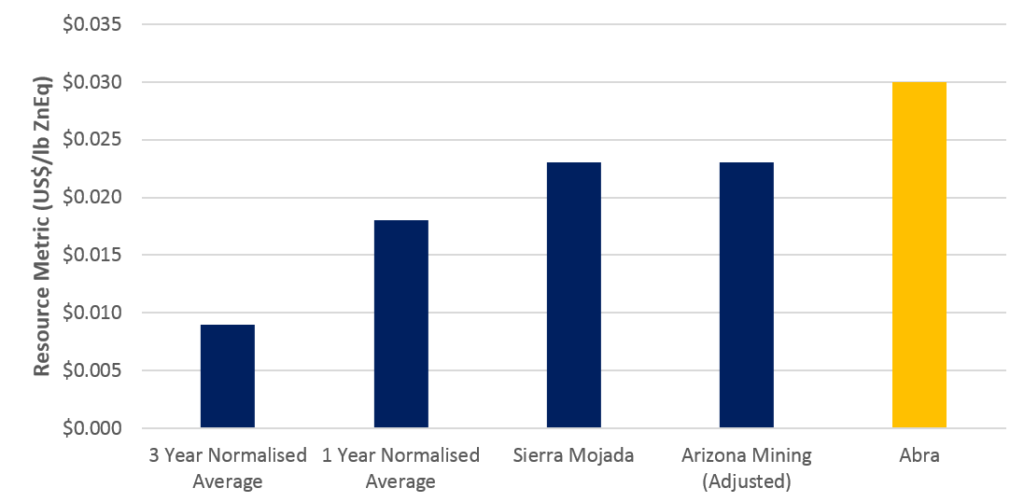

Two other transactions that may be worth considering from a price and value guidance perspective are the option agreement (the Option) between South32 Limited (South32) (ASX:S32) and Silver Bull Resources Inc. (Silver Bull) (TSX:SVB) and South32’s corporate acquisition of Arizona Mining Inc. (Arizona).

The Option agreement between South32 and Silver Bull, announced on 4 June 2018, gave South32 the right to acquire a 70% interest in the Sierra Mojada5 Project (Sierra Mojada) for US$100M less any amount spent on exploration at Sierra Mojada by South32 prior to exercising the Option. In order to maintain the Option, South32 is required to contribute a minimum of US$10M to exploration funding over a 4 year period.

Based on Sierra Mojada’s Mineral Resource estimate6 of 59.2Mt at 4.76% ZnEq7 the Option was granted at US$0.023/lb, a premium of 28% to the 1 year normalised average, 156% to the 3 year normalised average and a discount of 23% to the Abra transaction.

On 18 June 2018, South32 announced its intention to acquire Arizona in an all cash offer of C$6.20 per share for all shares not already owned by South32, paying US$1.3B in exchange for 83% of Arizona and effectively valuing the equity of Arizona at US$1.6B. Prior to this, South32 had paid US$81M for 15% of Arizona via a private placement in April 2017 and US$23M for 2% of Arizona via forward instruments and top-up rights between May 2017 and May 2018.

Based on the acquisition’s implied equity value of Arizona (adjusting for net debt) and Arizona’s latest Mineral Resource Estimate of 190.4Mt at 11.0% ZnEq8, MinesOnline.com has calculated a Resource Metric of US$0.034/lb ZnEq. Adjusting the US$0.034/lb ZnEq for the quoted 50% takeover premium to then allow a broad comparison on a project metric basis, South32’s acquisition of Arizona occurred at a metric of US$0.023/lb, a discount of 23% to the Abra transaction.

In summary, the Silver Bull Option agreement was priced at approximately US$0.023/lb and the Arizona transaction was also at US$0.023/lb ZnEq (adjusting for the corporate takeover premium of 50%) compared with the Abra transaction at US$0.030/lb ZnEq. Please see the bar chart below for a further comparison with the MinesOnline.com 1 year and 3 year normalised averages.

1 See Galena’s announcement here.

2 AUD:USD exchange rate of 0.7048 as at 31 December 2018.

3 MinesOnline.com notes that as the ratio of acquired ownership to consideration is the same for each tranche, the metrics are unaffected by the contingent nature of tranches 2 and 3.

4 Average metrics normalised using 31 December 2018 commodity prices.

5 Acquisition to occur via the subscription to 70% of the shares of Minera Metalin S.A. De C.V., a wholly owned subsidiary of silver bull which holds Sierra Mojada.

6 Resource estimate as at the date of the announcement.

7 Resource equivalent calculated based on commodity prices as at the date of the announcement.

8 Based on the quoted ZnEq grade for the Taylor deposit and a calculated ZnEq grade based on the quoted Oxide Value for the Central Deposit, sourced from Arizona’s NI 43-101 report dated 16 January 2018.

MinesOnline.com

The Global Marketplace for Mining Projects

Register today for free, unrestricted access to all project listings, market metrics and transaction valuations.

Projects can be posted on MinesOnline.com for a 5% success fee or a negotiated upfront posting fee.