MinesOnline.com Reviews Mincor’s Acquisition of the Long Nickel Project, Western Australia

MinesOnline.com Reviews Mincor’s Acquisition of the Long Nickel Project, Western Australia

On 23 May 2019, Mincor Resources NL (Mincor) (ASX:MCR) announced1 that it has agreed to acquire the Long Nickel Project (Long or the Project), located in Kambalda, Western Australia, from Independence Group NL (Independence) (ASX:IGO) for total consideration of A$9.5M (US$6.7M)2 via the acquisition of 100% of the share capital of Independence’s wholly owned subsidiary Independence Long Pty Ltd (the Transaction). Independence will also subscribe for A$1.5M (US$1.1M) worth of Mincor shares under Mincor’s A$23.0M (US$16.2M) capital raising announced on 24 May 2019.

Under the terms of the Transaction, Mincor will pay Independence A$3.5M (US$2.5M) in Mincor shares (comprising 7,777,778 fully-paid Mincor shares valued at A$0.45 (US$0.32) per share, Mincor’s closing price as at 22 May 2019, the last trading day prior to the announcement of the Transaction) upon closing of the Transaction, A$2.0M (US$1.4M) (payable in either cash or shares at Mincor’s discretion) upon the production of 2.5kt Ni from Long and A$4.0M (US$2.8M) (payable in either cash or shares at Mincor’s discretion) upon the production of 7.5kt Ni from Long.

Long, located 60km south of Kalgoorlie in Kambalda, Western Australia, is a historically active underground nickel sulphide mine that has been on Care and Maintenance since 2018. Independence acquired Long from WMC Resources Limited (WMC) in September 2002, recommissioned the Project in October 2002 and successfully operated the Project for 16 years producing ~10kt Ni per annum until June 2018. Prior to Independence, WMC operated the Project from 1980 to 2000. Since being placed on Care and Maintenance, Long has been well maintained with all key mining infrastructure and assets in place and the underground mine remaining de-watered and ventilated. The Project has JORC compliant Mineral Resources of 0.75Mt at 4.2% Ni for 32.0kt Ni.

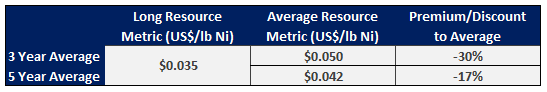

Transaction Market Metrics Comparison

Normalised Average Multiples3

As Long has previously operated, MinesOnline.com has attributed the Project Care and Maintenance status. On a Mineral Resource basis, Long transacted at US$0.035/lb Ni4, a discount of 30% to MinesOnline.com’s 3 year normalised average of US$0.050/lb Ni and a discount of 17% to MinesOnline.com’s 5 year normalised average of US$0.042/lb Ni.

Whilst Long is a relatively high grade nickel project, MinesOnline.com notes the relatively small size of the Project’s Mineral Resource and the great depth of the Project’s underground mine which may account for part of the Transaction’s observed discount to MinesOnline.com’s normalised average metrics. In addition to this, Long was considered to be a non-core asset for Independence resulting in the Project being placed on Care and Maintenance while Independence focused on its Nova Operation. However, MinesOnline.com notes that Independence will effectively retain a 4.2% interest in the Project through a shareholding in Mincor, facilitated by the shares it will receive as consideration under the Transaction and its participation in Mincor’s announced capital raising.

In the hands of the comparatively smaller Mincor, which has substantial existing nickel holdings in the Kambalda region, the Project has the potential to be revitalised and restarted to realise value, particularly with a favourable nickel outlook and BHP Group Limited’s (BHP) (ASX:BHP) refocus on nickel. MinesOnline.com notes that Mincor has signed a term sheet for a binding offtake agreement with BHP’s subsidiary BHP Billiton Nickel West Pty Ltd (Nickel West) to process nickel ore at Nickel West’s Kambalda Nickel Concentrator.

1 See Mincor’s announcement here.

2 Based on AUDUSD of 0.7037 as at 30 April 2019.

3 Average metrics normalised using 30 April 2019 commodity prices.

4 Only non-contingent consideration is included in the calculation of transaction metrics.

MinesOnline.com

The Global Marketplace for Mining Projects

Register today for free, unrestricted access to all project listings, market metrics and transaction valuations.

Projects can be posted on MinesOnline.com for a 5% success fee or a negotiated upfront posting fee.